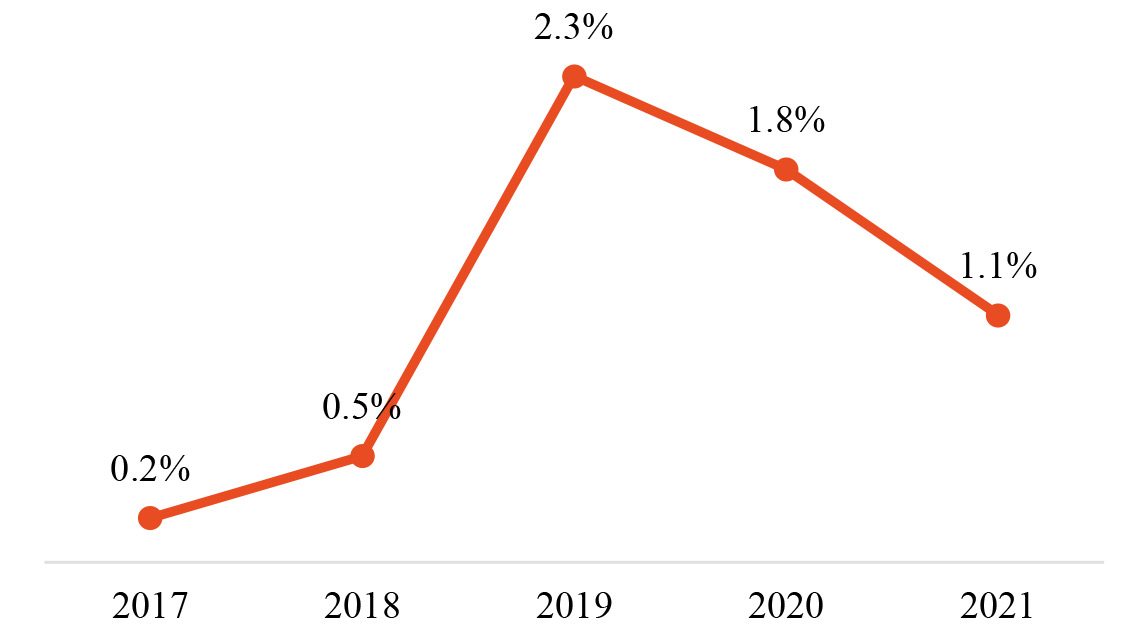

The preference for PE/VC investment in India has been entirely different compared to the high asset-intensive western markets and specific Asian markets such as China that have attracted huge VC/PE investments in deploying productivity-enhancing technologies or climate change adaptation technologies over the last decade.

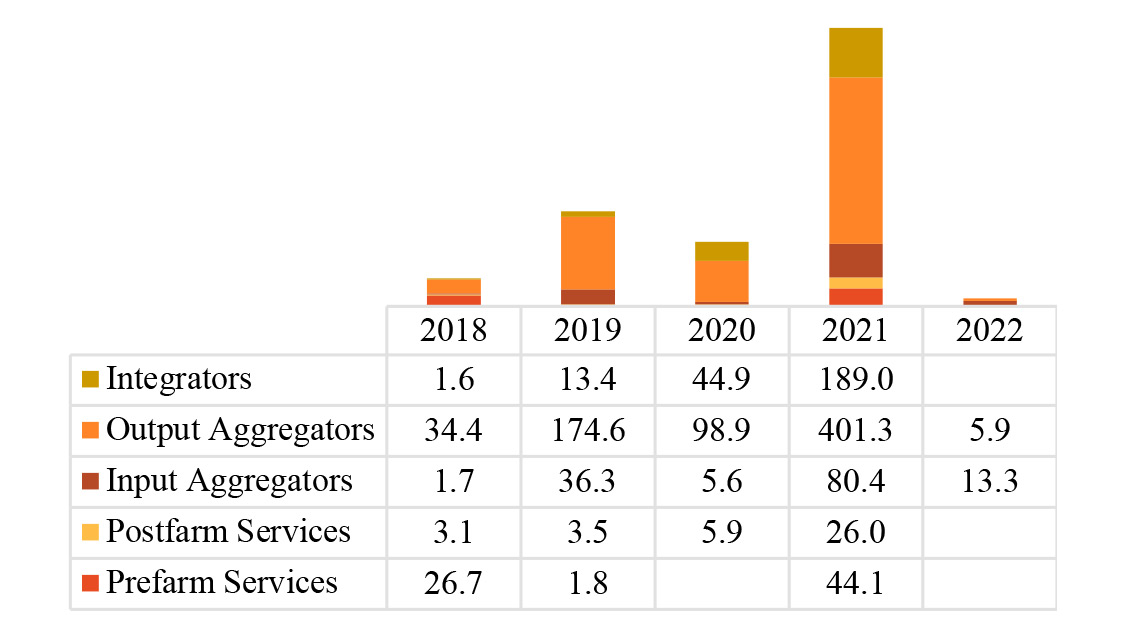

While global AgTech investments have witnessed dominant deployment in science-driven agri input products, value-added, sustainability-focused processed foods, and big data-driven discovery companies, these segments have attracted almost negligible investment from PE/VC investors or large corporations in India. Only two investments in high technology seed trait enterprises have been made during the last three years by PE/VC investors. The investment in new molecules or biotechnology-derived applications has been shunned due to the PE/VC industry not being adequately conversant with the complex regulatory framework and the inability to assess the technology risk in such ventures. The exception has been a single investment made in a bio-peptide entity in 2020. BIRAC, a government-led non-dilutive grant body, primarily supports these investments in early incubation. However, the valley of death has been profound for such enterprises due to the challenge of finding follow-on funding. Therefore, we classify the investment in AgTech in India broadly in the following segments.