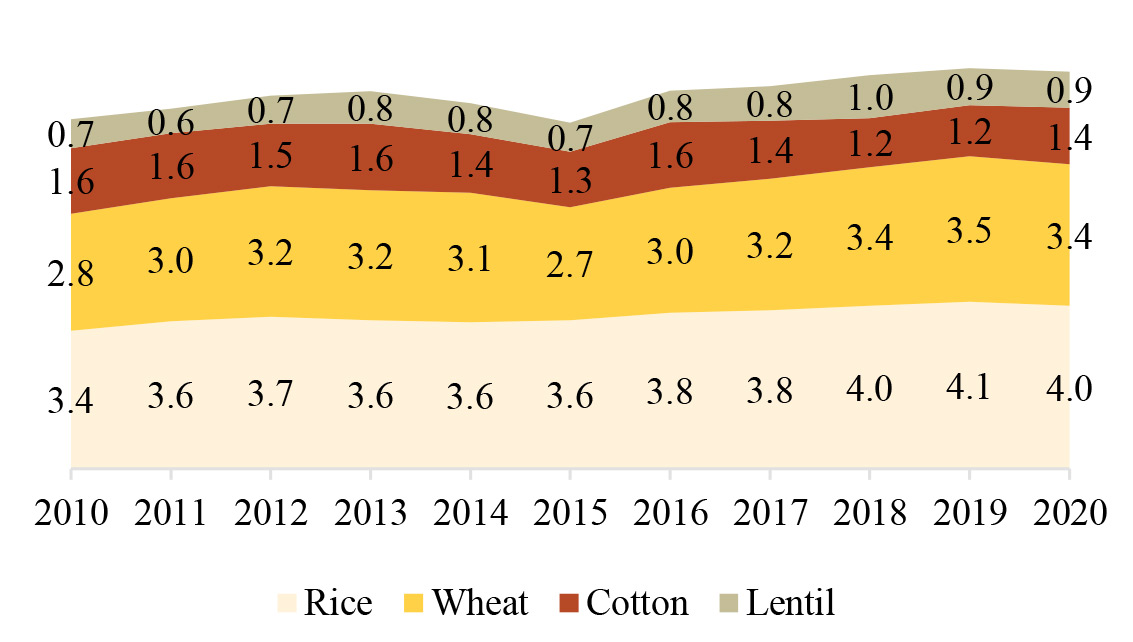

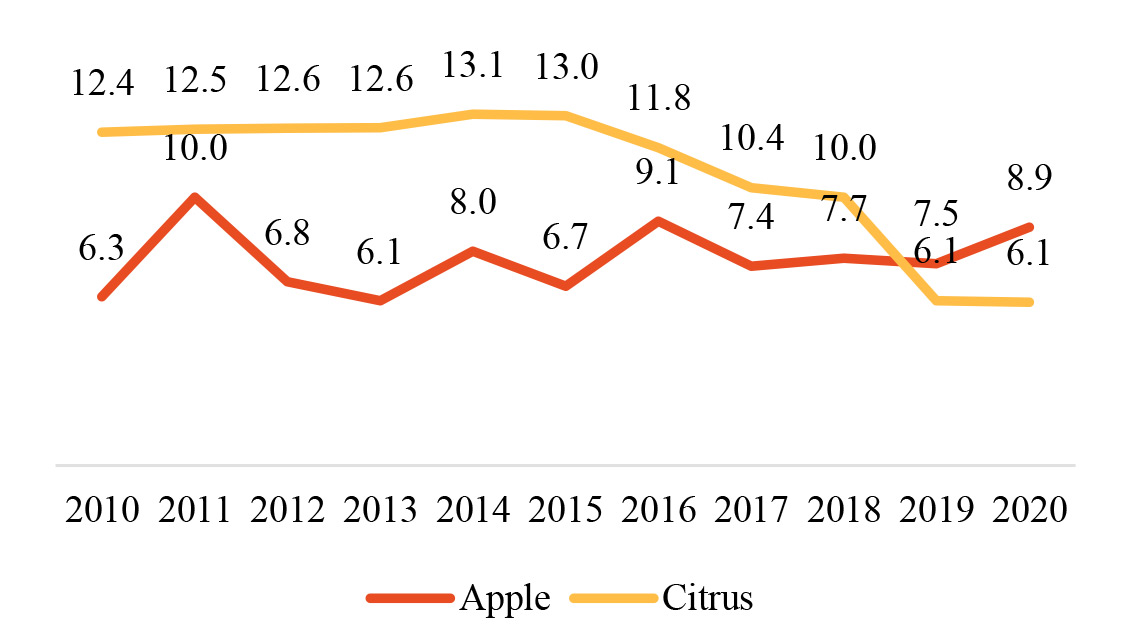

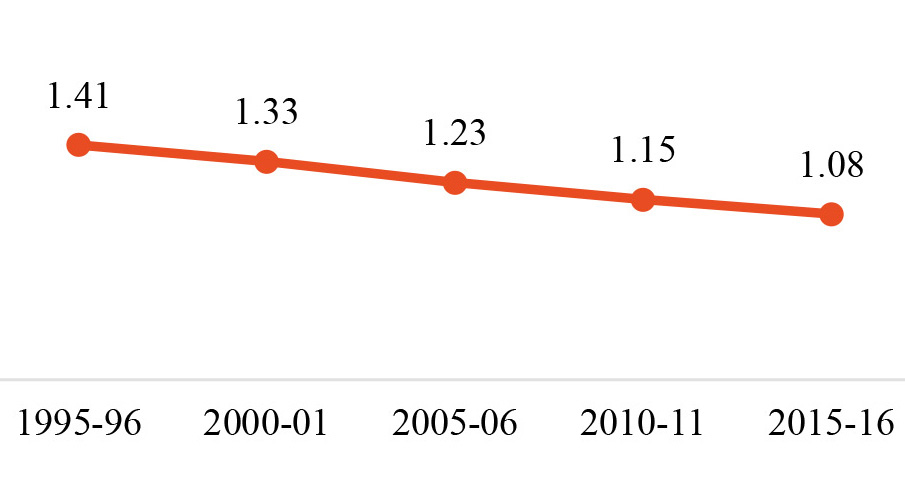

Indian farmers face the challenge of low productivity or stagnant productivity in most food crops and fiber crops (Figure 3). Commercial horticulture production, including fruit crops, is not the priority for crop nutrient suppliers. Planting materials for tree-borne fruit crops are sourced from unorganized nurseries. Except for wheat, the productivity in rice, millet, sorghum, and oilseeds such as groundnut, mustard, and soybean have been stagnant over the last decade. India is a net importer of protein-rich lentils with enlarging demand for consumption.