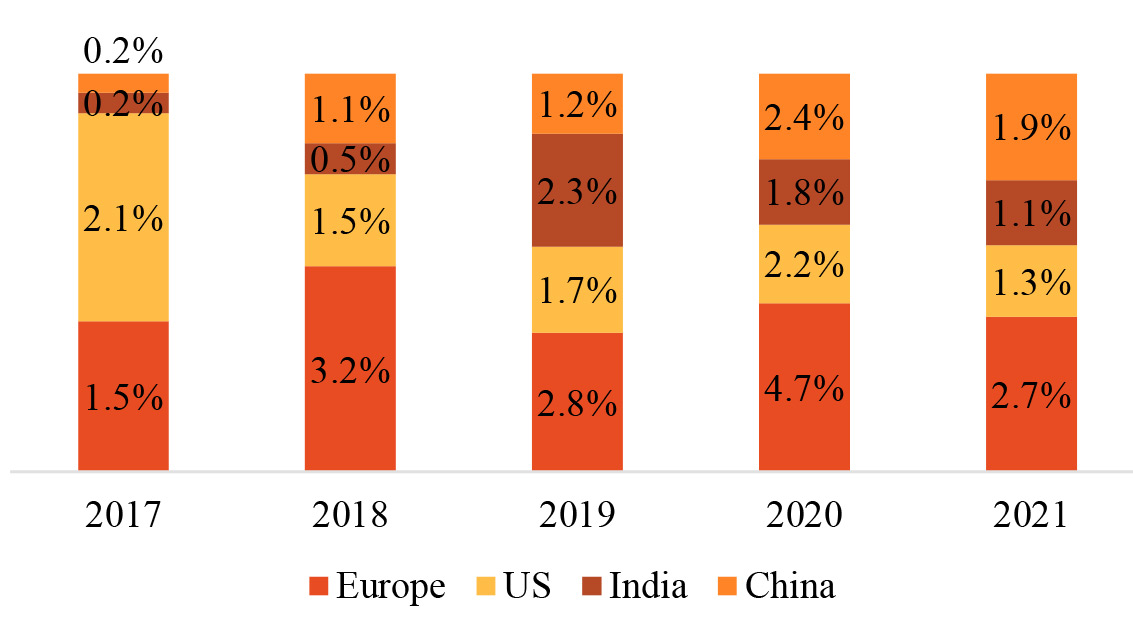

In Asia, China has leapfrogged with productivity increase in crops perceived as economically important. In horticulture, China has excelled in developing global dominance. In apple, China competes in productivity, duly adopting rootstocks and genetics from international sources and accomplishing productivity levels higher than other dominant apple-growing countries. China has also contributed to the highe st investment in agriculture research with the public and private sectors, contributing to increased investment in several facets of agriculture and food research, triggering improved farm input products such as seeds, crop nutrient solutions, crop protection solutions, and farming solutions for optimizing factor productivity.

Process innovations have contributed to high-quality protein for human and animal consumption from multiple sources. Cutting across the input and output sector, information technology and digital innovations combined with the advent of imaging technologies have enhanced the effective application of crop input optimally while providing better access to food for consumers with a highly efficient supply chain. While the impact of such technologies in predicting and preparing for increasing weather volatility is evident, the large-scale adoption of such technologies is effective in regions where there is no constraint of input such as seeds, nutrients, crop

protection products, and farm mechanization.